Editor's Note: All currency conversions are at current exchange rates

PANDORA PAPERS | An adviser to Malaysia's prime minister needed help managing companies in the capital city of Kuala Lumpur and in Hong Kong.

Prosecutors say he and his associates used the companies to divert hundreds of millions of dollars from a government economic development fund.

A Russian maker of Kalashnikov rifles, under international sanctions for bad behaviour, wanted to sell its shares in a large copper mine to a shadowy business in Mongolia.

The sale triggered a corruption probe of the then-Mongolian prime minister.

Tech giant Apple Inc was shopping for a tax haven to stash its mountain of offshore cash.

They all had a friend in America's biggest law firm.

When billionaires, multinationals and the politically connected seek to hide wealth or avoid taxes, they often turn to Baker McKenzie, the Chicago-based behemoth.

With 4,700 lawyers in 46 countries and revenue of US$ 3.1billion (RM12.94 billion), Baker McKenzie bills itself as "the original global law firm". It is among about a dozen US and UK firms that have established large international networks and transformed the profession of law itself.

Baker McKenzie says it is committed to the rule of law and the highest international standards for ethics, human rights and anti-corruption policies.

"We are truthful and transparent," the firm says in its code of business conduct. "We don't do business with disreputable characters."

Behind the lofty pronouncements is a plain reality: Baker McKenzie is an architect and pillar of a shadow economy, often called "offshore," that benefits the wealthy at the expense of nations' treasuries and ordinary citizens' wallets.

An investigation by the International Consortium of Investigative Journalists (ICIJ) reveals how Baker McKenzie has helped multinationals and the wealthy to avoid taxes and scrutiny through the use of shell companies, trusts and complex structures in tax havens.

These vehicles, shrouded in secrecy, hold vast riches - homes, yachts, stock and money - that are sometimes of murky origins.

Among the clients: people and companies connected to political corruption, fraudulent business practices and authoritarian regimes.

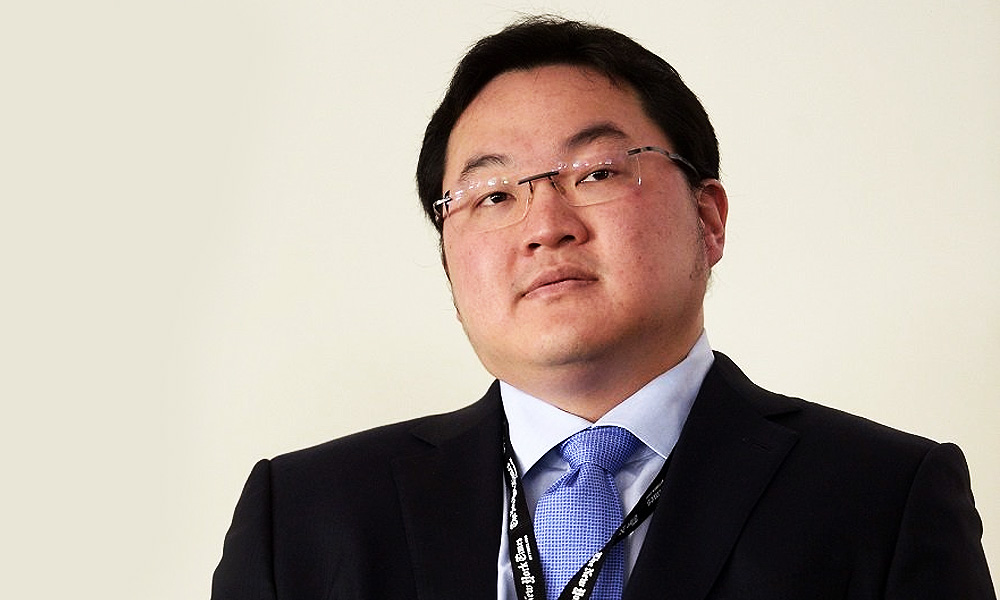

Jho Low, as an adviser to Najib Abdul Razak, then prime minister of Malaysia, made extensive use of Baker McKenzie affiliates.

Low is now a fugitive, accused of masterminding the multibillion-dollar looting of a public investment fund and wanted by Malaysia, the US and Singapore.

Rostec, the Russian arms maker that sold its stake in the Mongolian mine, is among a half-dozen state-controlled Russian companies that have awarded contracts to Baker McKenzie while facing international sanctions.

And Apple, which turned to Baker McKenzie to help it find a tax haven, has become the international poster child for corporate offshore tax avoidance.

The ICIJ investigation - based on a new leak of confidential records, thousands of pages of public documents, previously undisclosed internal files from other leaks and dozens of interviews - offers a rare, inside look at an elite law firm's role in the offshore economy.

More than 600 journalists plumbed 11.9 million new records, called the Pandora Papers, which were leaked from 14 financial service providers, from Dubai to Panama. They uncovered secret holdings of politicians, billionaires and business leaders and the actions of professional middlemen who sell tax avoidance and secrecy.

READ MORE: How Daim, M'sia's uber-rich use S'pore to store money offshore

Amid the sea of offshore bankers, accountants, lawyers and company formation agents, Baker McKenzie stands out.

ICIJ found that Baker McKenzie played a role in more than 440 offshore companies registered in tax havens, according to Pandora Papers documents and prior leaks. Typically, the firm connected clients with offshore service providers.

It has advised dozens of corporate giants on tax or offshore manoeuvres. The firm lobbies for them in Washington and other capitals and defends them if challenged by authorities.

Leaked documents reveal that the law firm helped arrange shell companies in Cyprus for food and tobacco giant RJR Nabisco. For Nike, it helped set up a Dutch tax shelter.

According to a US government court brief, its lawyers helped Facebook route billions of dollars in profits to low-tax Ireland.

In a series of written statements to ICIJ, Baker McKenzie said it seeks to provide the best legal and tax advice to help its clients navigate a "highly complex, ever-evolving and often conflicting" set of global rules.

"Transparency and accountability are integral elements of such advice," spokesperson John McGuinness said. "We strive to ensure that our clients adhere to both the law and best practice."

Panoramic view of a trailblazer

The assembled record provides a panoramic view of Baker McKenzie's role in shaping laws and regulations around the world, including its lobbying on measures concerning money laundering and tax shelters.

Acting on behalf of big banks and big tech companies, the firm pushed back against proposals aimed at strengthening financial regulatory oversight and tax laws.

In the United Arab Emirates, Baker McKenzie takes credit for helping to create free zones - areas of low taxes and light regulation that critics say have encouraged illicit activity.

In Australia, the law firm opposed a measure intended to curb offshore tax avoidance by big companies. And in the US, in lobbying for multinational banks, it sought to exempt more foreign customers from due diligence rules meant to prevent money laundering.

Globally, ICIJ found as part of the Pandora Papers investigation that more than 300 Baker McKenzie lawyers have advised or represented state, national or international bodies on matters such as international tax legislation and anti-corruption reforms.

READ MORE: Politicians, ministers and M'sian uber-rich revealed in latest offshore leak

More than 220 Baker McKenzie employees in 35 countries have held posts in government agencies, including justice departments, tax offices, the EU Commission and the offices of heads of state.

Although internal Baker McKenzie records are not among the leaked files, the firm is mentioned in more than 7,500 documents, far more than any other big US law firm.

Many of the documents mentioning Baker McKenzie come from three offshore providers to which the firm or its clients delegated work: Trident Trust, with offices in the British Virgin Islands; Alemán, Cordero, Galindo & Lee (Alcogal), a law firm based in Panama and Asiaciti Trust, based in Singapore.

One of the world's best-known corporate law firms, Baker McKenzie is also an industry trailblazer. It has adopted a model that allows partner firms overseas to benefit from a global brand without sharing profits or liability.

And it was an early champion of tax-planning strategies that let big companies and wealthy people shift profits to tax havens without actually moving operations there.

Tax-haven shopping has since become the bread and butter of the offshore industry, a strategy that leaves ordinary citizens to shoulder the financial burden that the rich and powerful escape.

Lawyers are central actors

Leading international organisations such as the Organization for Economic Cooperation and Development and the Financial Action Task Force have said that weak regulation of lawyers and other professionals plays a key role in global financial crime.

Yet unlike bankers and other offshore middlemen, lawyers have escaped scrutiny, in part because of attorney-client privilege, a doctrine requiring them to keep client information confidential.

In some countries, legal privilege exempts lawyers from reporting activities such as money laundering to government regulators.

A lawyer is more than a mercenary for the rich and powerful. According to the American Bar Association's Model Rules of Professional Conduct, a lawyer is an officer of the legal system and a public citizen with a special role to "further the public's understanding of and confidence in the rule of law".

Lawyers have a duty to do more than string together loopholes for a client and collect a big fee, said Richard Painter, a University of Minnesota law professor, who was the chief ethics lawyer for former US President George W Bush.

"Not being illegal doesn't make it right," Painter said.

Milton Cheng, Baker McKenzie's global chairperson who is based in Hong Kong, declined an interview. The firm declined to comment about client matters, citing "confidentiality obligations and legal privilege".

Spokesperson McGuinness, based in Singapore, said the firm performs strict due diligence and global background checks on all potential clients. He said Baker McKenzie "profoundly" disagreed with any assertion that it had many reputationally risky or disreputable clients.

"On occasion, we find that clients later engage in activities that are not consistent with our initial due diligence, or new facts or developments come to light which would cause us to terminate our representation of them," he said.

READ MORE: KINIGUIDE | Asset protection, financial privacy or tax evasion?

Baker McKenzie didn't directly respond to many questions about its role in the offshore economy or why its name appears so often in the records of offshore service providers.

McGuinness said Baker McKenzie routinely refers clients and legal matters to other law firms and service providers in jurisdictions where it doesn't have an office.

McGuinness added that Baker McKenzie is committed to a fairer and simpler global tax system.

"At the same time, we must clearly advise clients on their obligations under existing laws and regulations," he said.

Governments, regulators and industry groups regularly ask Baker McKenzie and other law firms to help develop and analyse legislation, McGuinness said.

The work is done in compliance with local lobbying laws, he said, and when hiring former government officials, Baker McKenzie strictly adheres to conflict-of-interest rules.

Chicago: A cab ride to a new world

Russell Baker was born in 1901 into a farm family in Portage, Wisconsin. When he was 12, the family moved to Texas, according to a law firm history. When he was 16, the Bakers moved again, to New Mexico, where Russell learned Spanish and developed a passion for diverse cultures that would blossom into a vision for the world's first global law firm.

He moved to Chicago to attend the University of Chicago and its law school. With a law school friend, he started his first law firm, specialising in helping Mexican nationals, in 1925.

In 1942, the US adopted the Western Hemisphere Trade Corporation Act, which offered tax breaks to companies manufacturing in Latin America.

Baker figured out a way for US corporations to qualify by shifting profits to low-tax jurisdictions.

It was the start of what Baker McKenzie calls one of the world's largest tax-planning practices, geared to helping companies make the most of the intricacies of the sprawling US tax code.

"A taxpayer has a right to arrange his affairs in any manner he chooses," Baker and a colleague wrote in a paper published in 1957.

"This concept is inherent not only in our tax law but is fundamental to our American way of life."

In 1948, Baker happened to share a cab with John McKenzie, a Chicago litigator, and before long, they were discussing the idea of an international law firm. They founded Baker & McKenzie the next year.

At first, the firm, now known as Baker McKenzie, handled international work out of its Chicago headquarters. Then it followed clients, like pharmaceutical giant Abbott Laboratories, as they expanded overseas.

It set up its first offshore outpost in Caracas, Venezuela, in 1955.

In an article in the Wisconsin Law Review two years later, Baker and a co-author recommended forming companies in Venezuela and other countries that allowed owners to remain anonymous through the use of so-called bearer shares.

Bearer shares are stock certificates that don't need to be registered under the name of a specific person or business.

"Nowhere in America is it possible to form a corporation with bearer shares," Baker and his colleague wrote.

"This is possible in a number of first-class foreign countries where the economic potential is practically unlimited."

Many countries would later ban bearer shares because bad actors used them to hide crimes and assets.

Baker McKenzie expanded rapidly, starting in the late 1950s, opening 20 offices in 15 years in far-flung locations such as Sao Paulo and Sydney.

It became the unconventional giant of the industry, with 76 offices worldwide and 4,700 attorneys, the most of any US law firm, according to the National Law Journal.

Other mega-firms followed - DLA Piper would grow to 4,000 lawyers; Norton Rose Fulbright to 3,180; and Latham & Watkins to 2,860, the journal's most recent survey found.

As the tax shelter industry grew, Baker McKenzie became an expert at helping companies route profits, at least on paper, to countries with low tax rates. And when a government moved to close a loophole, Baker McKenzie or other law firms would look for a new one.

From 'inversions' to McLaw with a Swiss twist

Take "inversions," for example. In an inversion, one company merges with another, usually a smaller one, in a low-tax jurisdiction, often realising huge tax savings.

The strategy emerged in the 1980s with "mailbox inversions," wherein US firms created shell companies at a post office box in the tax haven of Bermuda.

By 2002, then-US senator Max Baucus (D-Montana) called out Baker McKenzie, citing the firm's advice to Helen of Troy, a US cosmetic company that reincorporated in Bermuda in 1994.

"This question of inversions, I think, is a big problem, and promoters pushing them," Baucus said at a hearing on tax shelters. "Well recognised promoters pushing them."

He pointed to a passage from Baker McKenzie's website that promoted the use of inversions to "drastically" cut tax rates.

"Baker McKenzie has pioneered modern inversion transaction with the Helen of Troy inversion in 1994," Baucus read aloud at the hearing, and "since then has provided tax and corporate advice (to) about half of all publicly disclosed inversion transactions, and no other legal or accounting firm can make a comparable claim".

Decrying such "shams" that "rob the rest of the tax-paying public," Congress passed anti-inversion legislation that became law in 2004.

Five years later, the US Senate spotlight again fell on Baker McKenzie, this time at a hearing looking into offshore tax havens.

The firm had provided legal advice to Swiss banking giant UBS on how to handle American clients who didn't want their overseas assets disclosed to the Internal Revenue Service.

The bank, which overhauled its practices in 2009, said it doesn't "contract with any third parties for services that help others to avoid lawfully owed taxes".

Meanwhile, the tax-planning industry pushed new tax shelters, including a wave of increasingly complex inversion strategies.

Giant companies relocated their headquarters to more developed low-tax jurisdictions, like Ireland.

This trend prompted Baker McKenzie to issue a client brochure touting the firm's work with 16 corporations in various inversion transactions in a six-year period ending in August 2014.

Since creating its first overseas outposts, Baker McKenzie had always touted itself as a "one-stop shop".

It favoured a franchise model, with independent local firms sharing the same brand. Along the way, the firm picked up a nickname: "McLaw."

In the early 2000s, Christine Lagarde, a prominent lawyer in the Paris office and Baker McKenzie's first female global chair, set about to impose uniform standards for its member firms across the globe.

Under Lagarde, now president of the European Central Bank, Baker McKenzie reorganised as a "Swiss verein", centralising its branding, back-office and financing operations in a new corporate hub in the Netherlands.

Yet, the offices were never really unified. Baker McKenzie remained a loose confederation of independent member firms sharing branding, back-office services and marketing - but not profits or legal liability.

Other major firms would follow suit.

Hong Kong: Confecting a city of secrets

Hong Kong is a city of traders and shippers that has repeatedly transformed itself, expanding from shipping to manufacturing after World War II and then reinventing itself again.

With the UK's Caribbean dependencies already flourishing as tax havens in the 1970s, Hong Kong, on the other side of the offshore map, blossomed into Asia's premier tax and secrecy haven.

Also under the UK's guiding hand, the island was shifting from trading to banking, from colonnades to shining towers, a playground for Wall Street and the wealthy that never allowed sentiment to stand in the way of profit.

Enter Baker McKenzie. Its move onto the island in 1974 coincided with Hong Kong's metamorphosis, paving the way for the firm to benefit later from China's emergence as a global power.

Shortly after opening the Hong Kong office, several senior Baker McKenzie lawyers created two subsidiaries that stoked the island's red-hot market for avoiding tax and concealing ownership.

Partners John Connor and Robert Pick started B & McK Custodians Ltd, whose mission was to help form and manage companies in and outside of Hong Kong.

Two and a half years later, a colleague, George Forrai, helped create B & McK Nominees Ltd, housed in the law firm's Hong Kong office.

The affiliate arranged for stand-ins, known as nominees, to serve as company directors or shareholders.

Baker McKenzie's McGuinness said law firms routinely offer corporate services like that provided by B & McK Nominees and B & McK Custodians.

At the time, though, Western regulators were warning that some wealthy people in Hong Kong were forming anonymous offshore shell companies to avoid taxes.

Through innovation, local alliances and lobbying, Baker McKenzie helped transform Hong Kong into a global financial hub, famous for low taxes, high secrecy and minimal rules.

In two video-call interviews, Hong Kong billionaire Allan Zeman told ICIJ about his business journey from Canada to Hong Kong — and the role of lawyers at Baker McKenzie.

He said he turned to the firm for advice on forming companies in the British Virgin Islands for privacy reasons, not to avoid taxes.

"Hong Kong taxes are low enough already," Zeman said, adding that anonymous offshore companies offered some protection against unwelcome attention and lawsuits.

"Many times, you have partners who just don't want their name associated with something."

Zeman, 73, grew up in Canada and made his fortune trading garments around the world. He developed a go-to entertainment district in Hong Kong and became one of its most prominent business magnates.

He said he paid Baker McKenzie not only to help keep his financial interests private but also to advise him on legal ways to sidestep Hong Kong's strict regulations.

The law firm, he said, is a "one-stop shop" that helps him navigate a global patchwork of regulations in 36 countries.

"They'll tell you the best way… and make sure you're doing everything upfront, legally," Zeman said, adding: "They're not cheap. But it's worth it."

Feeding nominees to corporate giants

B & McK Nominees pumped out directors, shareholders and secretaries for hundreds of companies and entrepreneurs in Hong Kong, including Zeman's partner in the garment industry, Bruce Rockowitz, and corporate giants like Nike and Apple.

Neither Nike nor Apple responded to questions about why they used Baker McKenzie's nominee service in Hong Kong.

Nike said in a statement that it complies with all local rules. Apple called itself "the largest taxpayer in the world".

Rockowitz didn't respond to requests for comment.

Baker McKenzie said it sometimes supplied nominee shareholders to multinationals that didn't have local legal staff.

Another businessperson who turned to Baker McKenzie was Graeme Briggs, founder of the major offshore service provider Asiaciti. When he put money in a trust, the law firm's nominee service handled it.

Baker McKenzie also had a close relationship with Asiaciti, among other major offshore providers, according to records reviewed by ICIJ. The relationships appear personal as well as professional.

George Forrai, the Baker McKenzie partner in Hong Kong, introduced Briggs to his wife, according to a Pandora Papers document.

Other leaked documents show that Forrai was on Briggs' guest list to the Australian Open tennis tournament and to other private shindigs.

The two discussed potential business deals and when the government of Hong Kong approached Forrai about helping to craft tax policy in 2001, he asked Briggs to assist.

By then, the British had handed Hong Kong to China. The mainland's influence over the island's financial affairs loomed ever larger.

And Baker McKenzie gained a growing reputation as a go-to law firm for drafting laws and regulations.

In Hong Kong, Baker McKenzie lawyers wrote letters, served on advisory boards and consulted on laws and regulations.

The firm took issue with stricter due diligence standards, for example, and argued that more stringent disclosure requirements would be a regulatory burden on business.

The firm pushed its clients' public policy agendas in Hong Kong and elsewhere through non-profit lobbying coalitions with names such as the Association of Global Custodians, the Digital Economy Group and the Software Coalition.

Taxes, naturally, were of special concern. A Hong Kong government advisory panel that included Baker McKenzie lawyer Michael Olesnicky rejected the idea of changing the law to tax offshore income.

In an email, Olesnicky told ICIJ: "The panel was not opposed to taxing offshore income, but considered that this would simply collect more tax from existing taxpayers and therefore did not serve the function of broadening the tax base."

Baker McKenzie didn't respond to questions about which governments it assisted with which laws, or how much it was paid by such clients or special interest groups.

Spokesperson McGuinness called lobbying "a very small element" of the firm's practice.

Relationship with secretive billionaire Stanley Ho

Leaked documents show that one Baker McKenzie client who took advantage of Hong Kong's offshore tax exemption was the secretive billionaire Stanley Ho, who became known as Asia's gambling king.

Ho, who died last year at 98, helped transform Macau, a secrecy tax haven off the coast of China, into a major gambling hub.

The tycoon, who excelled at the tango and twice married dance enthusiasts, had four wives and 17 children. His fourth wife, Angela Leong, a director in Ho's casino business, would eventually register 71 companies in the British Virgin Islands, according to the Pandora Papers.

After China ended his 40-year Macau casino monopoly in 2002, Ho's luck turned sour.

The Chinese government was seeking to curb the growth of Macau's gambling market. A sister, Winnie, had filed more than 30 lawsuits against him, challenging, among other things, a reorganisation of his gambling enterprise, SJM Holdings.

The global economy was slowing, and profits were slipping.

State regulators in New Jersey were looking into allegations tying Ho to organised crime. Authorities in Portugal were investigating allegations of tax fraud at his casinos there. Australia had found him unsuitable to hold a gambling licence. Hong Kong regulators were asking questions about his plans to take SJM Holdings public.

Needing to attract new investors amid the flurry of probes and problems, Ho turned to Baker McKenzie and a consummate power lawyer in the firm's Hong Kong and mainland China offices, Lawrence Lee.

A transplant from the Sydney office, Lee juggled several roles.

He served as a director of Hong Kong's securities regulatory agency and later as its oversight chairman - monitoring people and companies, not unlike those he represented.

He also served as a nominee director for Ho's SJM Holdings, certifying corporate resolutions, among other duties.

Lee became a prominent advocate for easing rules to allow listings by more companies on the Hong Kong Stock Exchange. That prompted the Hong Kong exchange to push back against the "more relaxed approach" to accepting listing candidates.

Plus, Lee was director of an influential think tank, Bauhinia Foundation Research Centre, that was funded by an avalanche of cash - much of it provided secretly - from Hong Kong tycoons, including Stanley Ho.

Ho told the South China Morning Post that he pledged US$3 million to the Bauhinia Foundation in 2006. A couple of years later, Lee turned up as a nominee director of Ho's flagship casino company, as it sought a listing on the Hong Kong exchange.

The Bauhinia Foundation declined to release information about Ho's contributions or a donor list.

In a statement, the foundation called itself an independent policy group that has taken pro-worker stances.

It also pushed positions that benefited Stanley Ho: low taxes, light regulation of publicly traded companies and government subsidies for major infrastructure projects - including a 34-mile sea bridge and tunnel linking Hong Kong, China and Macau - that would aid his businesses.

After two summers of delays, Baker McKenzie advised SJM Holdings' successful debut on the Hong Kong exchange. The offering prospectus didn't mention that authorities in New Jersey were investigating Ho's companies for possible ties to organised crime.

Ho denied all allegations of wrongdoing.

The initial public offering raised about a half-billion dollars. Baker McKenzie issued a triumphant press release: "Our involvement in this high profile IPO of SJM Holdings further fortifies our position as the premier legal advisor on mega-listings and fundraisings on the Hong Kong Stock Exchange."

Today Ho's children and his fourth wife control a fortune pegged at US$14.6 billion in 2020. The law firm has represented Ho's daughter, Pansy Ho, the heir apparent to the empire.

In Asia, influence in Hong Kong meant the inside track to the region's big economic prize: China.

Baker McKenzie was clearly becoming the firm of choice for many Chinese state-owned enterprises looking to expand around the world, often using Hong Kong ownership structures.

In 2015, Baker McKenzie became the first foreign law firm to win approval to form a joint operation with FenXun Partners in China's low-tax Shanghai Free Trade Zone.

Among the mainland companies that Baker McKenzie advised were three that the US would blacklist in 2020 because of ties to the Chinese military.

The law firm represented AVIC International Holding Corp, a subsidiary of Aviation Industry Corporation of China (Avic), on a proposed privatisation deal.

Avic is a maker of fighter jets and one of the world's largest drone dealers. Human rights advocates have tied Avic drones to civilian casualties in airstrikes in the Middle East and North Africa.

In November 2019, for example, a UAE drone strike allegedly launched by an Avic Wing Loong-II killed eight civilians and injured dozens of others at a biscuit factory near Tripoli, Libya.

Baker McKenzie didn't respond to questions about its work with blacklisted Chinese state companies.

Malaysia: A wild ride to a US$4.5 billion fraud

Low Taek Jho, a charismatic scion of a well-connected Malaysian family, established his first company while an undergraduate business student at the University of Pennsylvania.

He returned home to launch a glittering career in finance, one that made him so rich he acquired a tabloid name - Jho Low - along with a stake in Martin Scorsese's 2013 Hollywood blockbuster, "The Wolf of Wall Street", and pals such as Paris Hilton, Leonardo DiCaprio and Victoria's Secret model Miranda Kerr, on whom he lavished US$8 million in jewellery.

Starting in 2004, Low relied on Baker McKenzie and its affiliates, along with a handful of trusted associates, to build a network of companies in Malaysia and Hong Kong.

He entered a world of political fixers, exclusive nightclubs and multimillion-dollar deals that most business school grads only dream of.

Low and his associates used the companies to buy luxury hotels in New York City and Beverly Hills, bankroll private equity investments and funnel funds to then-Malaysian prime minister Najib Razak, court records show.

A 50-year-old manager of B&M Consultancy Services, a Baker McKenzie affiliate, became a key consultant for eight Low-connected companies in Malaysia. Low enlisted another affiliate, B & McK Nominees, to set up three companies in Hong Kong.

After Najib was sworn in as prime minister in 2009, Low became a dealmaker for a government investment fund meant to provide public works projects and good jobs for Malaysians.

The fund, called 1Malaysia Development Berhad, would become notorious by its abbreviation: 1MDB.

Lim Poh Seng, the Baker McKenzie-affiliated corporate secretary, worked for 1MDB from the start. He acknowledged publicly for the first time recently that he worked for Jho Low's companies as a B&M Consultancy employee.

Testifiyng at a trial of former Prime Minister Najib in Malaysia, Lim said Jho Low approached him in 2008 to take minutes at a meeting of a state fund that was a precursor of 1MDB.

Lim said he then became 1MDB corporate secretary, attending board meetings and performing other key corporate functions after the Malaysian federal government took over the state fund in 2009.

Soon after, Baker McKenzie's member law firm in Malaysia, Wong & Partners, represented the 1MDB fund in a US$1 billion (RM4.17 billion) transaction with a private Saudi oil company called PetroSaudi.

The deal and others were supposed to finance energy and development projects.

Instead, much of the money flowed to shell companies and other opaque entities controlled by Low and his associates, according to US and Malaysian authorities.

Prosecutors say more than US$4.5 billion (RM18.79 billion) was diverted from 1MBD into private pockets through a labyrinth of shell companies, trusts and bank accounts in one of the world's biggest-ever financial frauds.

Red flags everywhere

Money laundering experts say Low fit the textbook definition of the high-risk client. He used Swiss bank accounts and business entities stocked with family members. He also had close ties to politicians, including Najib, the former prime minister.

"Everybody had blinders on about Low," said Keith Prager, a former US customs agent and money laundering expert who reviewed the case for ICIJ.

"There were red flags everywhere."

Baker McKenzie's ethics guide counsels its lawyers to ask themselves questions to help make the right choices: "Would I be embarrassed if friends or family knew I did this? … Could this cause harm to the firm or damage its reputation?... Would I be embarrassed if this were reported in a blog or news story?"

ICIJ's review found that besides Jho Low, Baker McKenzie and its affiliates did business with reputationally risky companies and individuals in several countries.

They include an enterprise owned by Du Shuanghua, a Chinese steel kingpin, who had testified to giving US$9 million (RM37.57 million) to a mining official later convicted for graft; Ukrainian oligarch Ihor Kolomoisky, who US authorities said used a chain of shell companies in a US$5.5 billion (RM22.96 million) money-laundering scheme; and heirs of the late Khoo Teck Puat, widely known as Singapore's richest man, who was accused of running a bank into a financial abyss.

Du Shuanghua, Kolomoisky and Jennifer Khoo Carmichael, daughter of the late banker, did not respond to requests for comment.

Baker McKenzie didn't answer questions about individual clients. McGuinness said anti-money-laundering rules and due diligence standards have evolved, and some client matters might have occurred before strict rules and vetting standards were in place.

Now the law firm performs comprehensive checks on all potential clients, screening for "politically exposed persons" and their close associates and family members.

"We have improved our systems over the years to their current robust intake risk management state … and are always striving for further improvements," McGuinness said.

Lim Poh Seng, the Baker McKenzie-affiliated corporate secretary, declined to comment about the Jho Low case. Wong & Partners, Baker McKenzie's member firm in Malaysia, didn't respond to requests for comment.

Wong & Partners previously called its 1MDB role strictly "advisory" and said it did nothing wrong.

1MDB sued in Malaysian courts in May to recover US$1 billion (RM4.17 billion) in damages from Wong & Partners but dropped the case less than three months later.

Baker McKenzie wasn't alone among professional firms in aiding Low and his associates. Other white-shoe law firms, Big Four auditors and even the venerable investment bank Goldman Sachs enabled the globe-spanning fraud.

Goldman later admitted conspiring to pay more than US$1.6 billion (RM6.68 billion) in bribes to Malaysian and Abu Dhabi officials. Goldman's Malaysian unit pleaded guilty in to bribery-related charges in US federal court.

The bank agreed to pay nearly US$3 billion (RM12.52 billion) to officials in four countries and to claw back US$174 million (RM726.36 million) from top executives.

Goldman Sachs declined to comment. It previously called its role in the 1MDB looting an "institutional failure" and vowed to improve oversight.

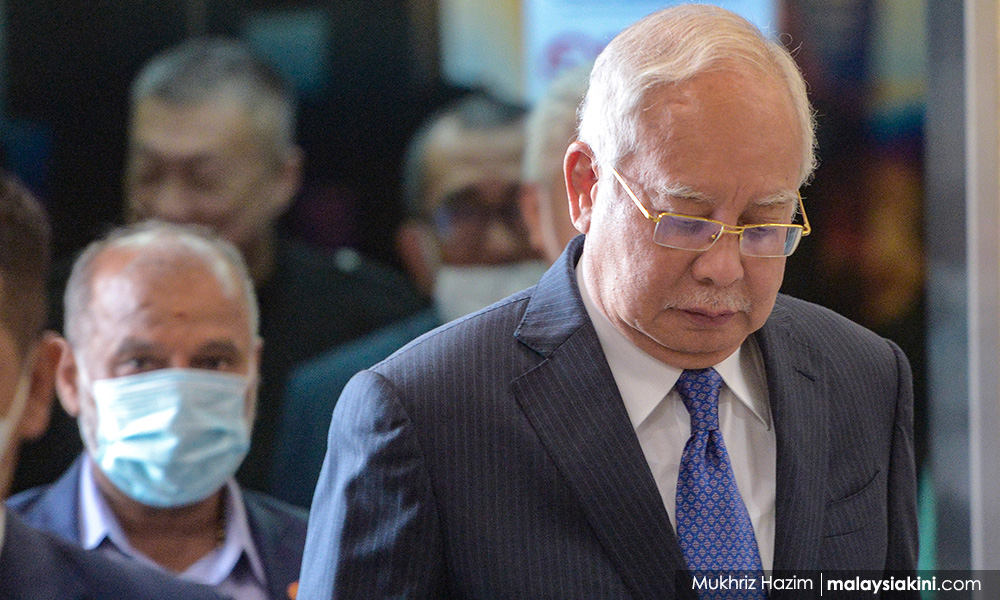

A Malaysian court sentenced Najib, the former prime minister, to 12 years in jail after he was found guilty last year in his first 1MDB-related corruption trial. 277 His sentence was stayed pending an appeal, and he faces four more 1MDB-related trials.

Najib told ICIJ in text message-delivered answers to questions that he played no direct role in the 1MDB bribery ring. He placed blame on Baker McKenzie and other professional advisers.

"I was comforted that these are big brand-name firms and that they would have alerted me or the board of 1MDB should there be any red flags," said Najib, who was voted out of office in 2018.

"However, such warnings never came."

Jho Low, 39, has been in hiding for more than five years. Attempts to reach him were unsuccessful.

In an interview published last year, he denied that he was the brains behind the 1MDB scheme.

"The idea that I am some kind of 'mastermind' is just wrong," he told Singapore's Straits Times, conducting the interview by email.

He has been spotted intermittently in Phuket, Thailand; Macau; mainland China; Hong Kong; Taiwan; Hollywood; and Ahmedabad, India.

Miami: Mansions in the money maze

As head of Baker McKenzie's North American wealth management group, Simon P Beck is a speaker in demand.

A lawyer, tax adviser and trust expert, Beck regularly speaks at conferences and industry boot camps - some held at five-star hotels.

Topics include subjects like the use of trusts and offshore tools to shield clients from creditors and how to place assets beyond the reach of "spendthrift or hostile" relatives or divorced spouses.

Though he is based in New York, Beck is also part of Baker McKenzie's formidable Miami team of tax and trust experts, which has advised some of the world's richest people on how to protect their fortunes.

Often, the Pandora Papers show, the solution is to stash it in a shell company or trust set up in a tax haven.

From its 17th-floor offices a block from Biscayne Bay, the Miami office has handled dozens of anonymous companies and trusts for foreign clients. The clients used offshore entities to hold luxuries, real estate and investments, leaked documents show.

Baker McKenzie introduced clients to offshore service providers, advised them on tax matters, kept offshore records, provided due diligence, wrote reference letters and more, according to ICIJ's review of confidential records.

Often the firm delegated work to service providers specialising in churning out shell companies, such as Trident Trust.

The co-owner of the Ottawa Redblacks, a Canadian Football League team, was a client — he sought "insulation" from US estate taxes. So was a Peruvian insurance executive now under investigation for public corruption related to the Odebrecht construction scandal and the 100-year-old mother of a tax cheat convicted of tax fraud and money laundering.

Beck himself handled matters for Thais Neves Birmann, ex-wife of Daniel Birmann, a onetime financier, banker, and shareholder in one of Latin America's largest ammunition companies.

In 2005, Brazilian authorities fined Daniel Birmann about US$90 million (RM375.70 million) for improperly profiting from the restructuring of electronics maker SAM Industrias SA. At the time, it was the largest fine ever imposed by Brazil's securities regulators. Birmann declared bankruptcy and allegedly concealed assets by transferring them to family members, including Neves Birmann.

A decade later, with the bankruptcy still underway, Brazilian authorities seized a US$20 million (RM83.49 million) yacht that they said Birmann secretly owned through a shell company incorporated in the Isle of Man.

Brazilian securities regulators would ask a court for permission to sell the yacht to collect on the US$90 million (RM375.70 million) fine. In April 2016, they sought permission to seize other undisclosed assets, including nearly US$4.6 million (RM19.20 million) in unpaid loans that Birmann made to his ex-wife and other relatives.

Later, in July 2017, Baker McKenzie and Trident Trust set up a company called Waymoore Partners with Neves Birmann as the owner. It held a five-bedroom home on Miami Beach valued at US$1,875,000 (RM7.83 million).

Neither Birmann nor his ex-wife responded to questions about the alleged hiding of assets from creditors or about the source of funds used to buy the Miami house. Beck didn't respond to questions about the Birmann case or his offshore work with other very wealthy clients, including Colombian-born billionaire Jaime Gilinski Bacal.

Gilinski, 63, turned a small inherited fortune into a globe-spanning, US$3.7 billion (RM15.45 billion) banking and real estate empire, according to Forbes.

Leaked documents show that at least some of his assets have been stored in more than three dozen companies in the British Virgin Islands and Panama, where he is a citizen and once held a diplomatic post.

In a 2017 letter to Trident Trust, attorney Beck said he had represented Gilinski since 2003.

"Mr Gilinski has always conducted himself in an honourable and highly reputable manner," the letter said.

In 2004, US financial regulators ordered Gilinski's Eagle National Bank of Miami to stop foreign political figures from operating bank accounts potentially tainted by "money laundering, the proceeds of foreign corruption, terrorist financing or other suspicious activity".

A few months later, the US issued a cease-and-desist order directing the bank's parent company to stop making insider loans to Gilinski and his businesses.

Gilinski did not respond to requests for comment. The bank said at the time that it had stopped lending to any affiliated companies.

The US eventually dropped both orders after the bank and its holding company satisfied regulators' concerns.

Colombia's financial regulators have penalised Gilinski's Banco GNB Sudameris 16 times since 2005, including once for violating anti-money-laundering procedures, records show. In all, the regulators ordered the bank to pay about US$394,000 (RM1.64 million) in fines.

Documents reviewed by ICIJ show that Beck was part of a team of professional middlemen working on the banker's business empire.

Among the others was Jaime Alemán, the politically influential founder of the Panamanian law firm Alemán, Cordero, Galindo & Lee (Alcogal), also a longtime Baker McKenzie business associate and friend of Gilinski.

In August 2012, during a time of intensifying international pressure on Panama's offshore industry, Beck helped Gilinski relocate his Panama company, Glenoaks Investments, to the British Virgin Islands. Gilinski had used Glenoaks to invest in his Bogota-based bank.

The reason for the move: "US tax planning," Beck wrote in an email to Alcogal.

Gilinski used two other BVI companies handled by Baker McKenzie to hold a London mansion valued in 2013 at US$38 million (RM158.63 million), records show.

And records show he paid US$14.5 million (RM60.53 million) for a seven-bedroom house - one of four properties he acquired using two other offshore companies - on a private island in Miami known as Billionaire Bunker.

The guarded and gated property is down the street from a 1.3-acre estate that Ivanka Trump and Jared Kushner reportedly bought for US$24 million (RM100.19 million) this year.

Russia: Heady brew to sanctions expert

In March 2016, the state-owned Russian arms company Rostec went looking for help to sell its stake in one of the world's largest copper mines. The mine is in Mongolia and was named Erdenet, Mongolian for "treasure".

Rostec manufactures nearly everything the Russian military uses, from fighter jets and helmet-mounted night vision goggles to armoured vehicles and Kalashnikov rifles.

At the time of the mine deal, Rostec was under Western sanctions after Russia's 2014 invasion of Crimea.

With some of its affiliates, the company had also come under media scrutiny because of allegedly corrupt arms deals. And according to the Pandora Papers, relatives of Rostec's chief executive, Sergey Chemezov, an old friend of Russian President Vladimir Putin, had set up an offshore shell company to hold real estate.

In soliciting a law firm to help with the Mongolia mine sale, Rostec required "experience in advising Russian organisations that have been sanctioned … by the United States and the European Union".

Baker McKenzie won the job through an affiliate, Baker & McKenzie CIS.

Baker McKenzie calls itself the first Western law firm accredited in Soviet times, opening up in Moscow in 1989.

After the fall of the Soviet Union, Baker McKenzie partners adopted the name Baker & McKenzie CIS to handle work in former Soviet Republics. Its name derives from the Commonwealth of Independent States formed in the wake of the Soviet collapse.

With one of the largest practices in the region, Baker & McKenzie CIS counts as clients some of the largest Western companies operating in the former Soviet Union, including the likes of Ford Motor Co and Carlsberg beer.

ICIJ and its partners at the Organized Crime and Corruption Reporting Project and the IStories media outlet found that Baker & McKenzie CIS has represented at least six sanctioned companies owned by the Russian government, including Rostec and banking giant VTB.

In March 2018, for instance, Baker & McKenzie CIS won a contract with a unit of VTB, dubbed "Putin's piggy bank," after reports that members of the Russian president's inner circle were moving vast sums of money offshore through a VTB subsidiary.

The law firm was hired to advise VTB on how to avoid running afoul of US or EU sanctions in its funding of an airport project near St Petersburg.

Russia has continued to draw Western sanctions because of efforts to influence US presidential elections, a cyberattack and the poisoning of a former Russian spy.

The US Office of Foreign Assets Control, which manages economic and trade sanctions, allows lawyers to provide legal services to sanctioned Russian entities.

While there's no evidence that Baker & McKenzie CIS violated any rules, some ethics experts question whether the law firm's work may follow the letter but sidestep the spirit of sanctions laws.

"If you're representing entities that are sanctioned, one really needs to ask the question: As far as being a good corporate citizen, do you really want to provide services to entities that are absolutely recognised by governments as being bad actors?'" said Timothy White, special adviser to AML RightSource, an anti-money-laundering consulting firm.

In June 2016, Rostec sold its stake in the Erdenet mine to a little-known company called Mongolian Copper Corp for US$400 million (RM1.67 billion).

Around the time of the sale, anti-money-laundering monitors from Deutsche Bank filed suspicious activities reports detailing the flow of hundreds of millions of dollars to Mongolian Copper.

" There is little to no information regarding the specific creation and business" of Mongolian Copper, Deutsche Bank reported, according to records obtained by BuzzFeed News and shared with ICIJ as part of its 2020 FinCEN Files investigation.

Political firestorm in Mongolia

In Mongolia, the sale triggered a political firestorm, court battles and high-level corruption probes, with then-Prime Minister Chimed Saikhanbileg as one of the targets.

Mongolia's Parliament ruled the sale illegal, finding that Saikhanbileg authorised it without lawmakers' approval. Mongolian investigators also uncovered evidence that Mongolian Copper was a front for the privately-owned Trade and Development Bank of Mongolia.

The politically influential bank, whose investors included Goldman Sachs, had improperly used public funds to finance the purchase, investigators said.

Goldman Sachs had a 4.8 percent stake in the bank but said it exercised no strategic control.

Robert Amsterdam, an attorney for Saikhanbileg, said the former prime minister played no role in the sale and did nothing wrong.

Rostec identified Mongolian Copper Corp on its own, Amsterdam said, and was unwilling to sell its stake to any other buyer.

"Mongolia's reputation as a place to do business has been damaged by the politically charged nature of the investigation into Erdenet," he said.

Citing client confidentiality, Baker McKenzie declined to answer questions about the Rostec contract or the firm's dealings with other sanctioned Russian companies.

The law firm said it simply offered clients advice on how to comply fully with trade sanctions.

Rostec declined to comment.

Baker & McKenzie CIS's registered office is listed as a first-floor suite 384in a building on the English Channel island of Guernsey. According to the Tax Justice Network, a nonprofit group that examines countries' financial secrecy policies and practices, Guernsey is the 11th-most-secretive tax haven in the world.

ICIJ partner Le Monde found that Baker & McKenzie CIS's Guernsey office has no operations and that it is, in fact, a shell.

Contributors: Sydney P Freedberg, Agustin Armendariz and Jesús Escudero, Karrie Kehoe, Maggie Michael, Emilia Diaz-Struck, Ben Hallman, Dean Starkman, Fergus Shiel, Delphine Reuter, Miguel Fiandor, Mago Torres, Jelena Cosic, Richard H.P. Sia, Tom Stites and Denise Hassanzade Ajiri. Reporting from around the globe by Le Monde of France; Malaysiakini of Malaysia; Stand News of Hong Kong; OCCRP and iStories in Russia; Tanya Kozyreva in Ukraine; Australian Broadcasting Corp. and Australian Financial Review in Australia; Karlijn Kuijpers in the Netherlands; The Guardian and BBC in the United Kingdom; The Washington Post, the Miami Herald and The Wire China in the United States; Agencia Publica of Brazil; El Espectador/Connectas of Colombia; Quinto Elemento Lab of Mexico; woxx of Luxembourg; Convoca of Peru; Korea Center for Investigative Journalism-Newstapa in South Korea; Indian Express in India; Armando.info in Venezuela; Tempo of Indonesia; L’Espresso of Italy; Expresso of Portugal; WDR in Germany; NZME of New Zealand; and El País in Spain.

Related stories

- KINIGUIDE | Asset protection, financial privacy or tax evasion?

- How Daim, M'sia's uber-rich use S'pore to store money offshore

- Daim rues M'kini's 'obsession' with him, says offshore trusts legit

- Politicians, ministers and M'sian uber-rich revealed in latest offshore leak

- Hidden riches of world leaders, billionaires exposed in unprecedented leak

- Anwar wants Dewan Rakyat to debate controversial Pandora Papers

- Zahid on offshore accounts: 'Do not assume I was trying to evade tax'

- Zafrul: I have relinquished all posts in Kenanga Group in June 2010