COMMENT | Ramadan is a period of cleansing and renewal for all Malaysians. The federal government is continuously working to inculcate a similar spirit into the administration and the country at large. And we have been blessed with some results.

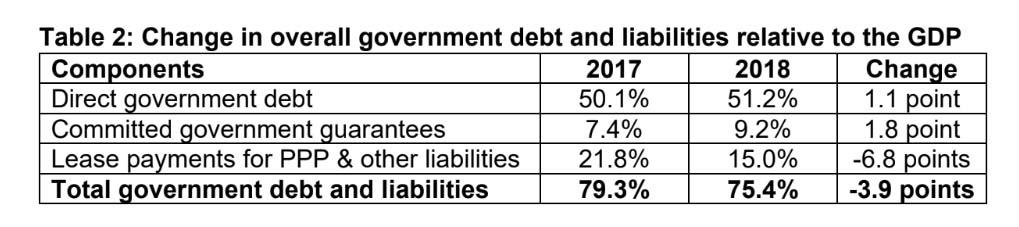

One example has been the ability of the government to control and reduce its overall debt and liabilities to 75.4 percent of the GDP in 2018 from 79.3 percent in 2017, as announced by the newly established Debt Management Committee.

Despite a rise in direct government debt, overall government debt and liabilities dropped 3.9 percentage points due to successful cost rationalisation of both overpriced megaprojects and public-private partnership (PPP) payments.

Debt higher without cost savings

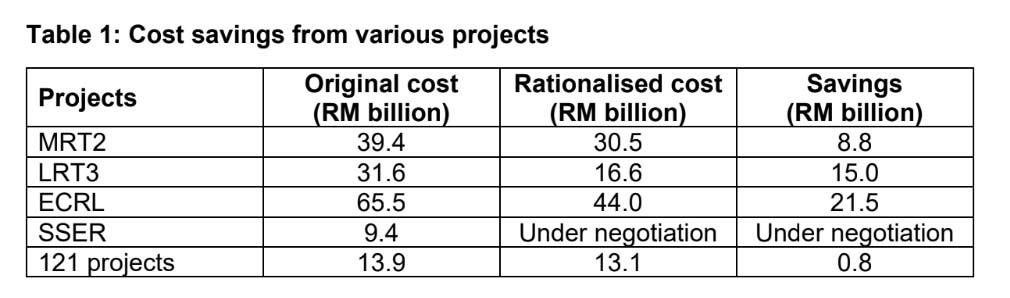

The federal government’s debt and liabilities would have risen higher were it not for various cost rationalisation efforts on the East Coast Rail Link, MRT2, LRT3 and other megaprojects.

For instance, the cost of the LRT3, which would have been borne by the government largely through committed government guarantees, has been cut by 47 percent or RM15.02 billion.

MRT2 saw a savings of RM8.8 billion, whilst 121 smaller infrastructure projects worth more than RM13.9 billion nationwide saw savings of RM806 million.

Meanwhile, there is an RM21.5 billion savings on the ECRL, costing RM44 billion now from its original cost of RM65.5 billion.

Yet another example is the cancellation of the two pipeline projects under Suria Strategic Energy Resources Sdn Bhd (SSER), in which 88 percent of the RM9.4 billion total cost has been paid despite only 13 percent of work purportedly done.

Additionally, the claimed work done cannot be verified. To this day, no explanation has been given by the previous government for why they approved such an unfair contract detrimental to the government and the people of Malaysia, and overly generous and beneficial to contractors.

Table 1 highlights the savings made by the present government from the cost rationalisation exercise on MRT2, LRT3, ECRL, SSER and 121 other projects.

Composition of overall debt and liabilities

To refresh everybody’s mind, the components of the overall debt and liabilities are direct government debt, committed government guarantees that are serviced by the government, and lease payments from various PPP projects, as well as other long-term liabilities.

Table 2 shows the composition of the overall debt and liabilities in 2017 and 2018, as well as its changes.

The overall drop in percentage terms occurred despite a rise in direct government debt and committed government guarantees serviced by the government.

Direct government debt rose by 1.1 percentage point to 51.2 percent of GDP in 2018 from 50.1 percent in 2017. The rise was to finance the fiscal deficit as it has been done annually under the previous administration.

Committed government guarantees rose by 1.8 percent point to 9.2 percent of GDP in 2018, from 7.4 percent in 2017.

The rise in committed government guarantees was caused by the continuing payments for various existing infrastructure projects. These are not new projects, and among them are for the MRT, Pan-Borneo Highway and the ECRL megaprojects entered into by the previous administration.

Finally, other commitments made by the previous government included lease payments for PPP and other liabilities (such as 1MDB), which fell by 6.8 percentage points to 15.0 percent of GDP in 2018 from 21.8 percent in 2017.

It is this component that enabled the government to successfully reduce its overall debt and liabilities within one year.

The government will continue to reduce its overall debt and liabilities, and not just the direct debt component.

The government’s newly established Debt Management Committee is pressing on with its fiscal consolidation exercise to slow down the growth of direct government debt, without affecting the economy’s growth.

This exercise, along with cleaner and good governance, will help reduce the overall debt and liabilities of the government further in 2019 and beyond.

LIM GUAN ENG is the finance minister.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.