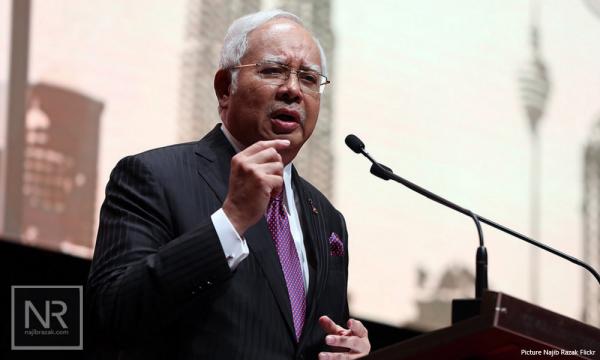

In a lengthy Facebook post today, former prime minister Najib Abdul Razak warned of more tax evasion and other illicit economic activity once the sales and services tax (SST) is reintroduced.

Najib said he introduced GST during his administration not just to increase federal revenue, but also because of the comparative advantages of the tax.

Otherwise, he added, all he would have had to do was raise SST, corporate tax, income tax, or appropriate funds from Petronas to raise money.

The former premier maintained that GST was introduced to make Malaysia's economic structure more stable and competitive.

Although GST does raise more revenue that the SST it replaced, he explained, it is not simply because the tax is imposed on more items – since it has nearly as many exemptions as the SST about to be reintroduced.

Instead, he said the increased revenue under GST is due to a reduction in tax evasion and avoidance. This is because it allows for taxation on the black economy, illicit capital outflows, migrant worker remittances and the tourism industry.

“It is here where a large portion of the tax revenue came from. Under the sales tax system, manufacturers or importers could set up a distribution company that acts as their proxy, and then sell products cheaply to the distribution company," his Facebook post read.

“The sales tax is only applied on manufacturers and importers, and this allows them to declare a lower sales tax.

“Or, a shop that is supposed to collect service tax could keep the collections, and not return a large portion of it to the government. Unlike GST where they could claim input tax credits, there is no incentive under SST for them to declare the true amount.

“Under GST and a self-monitoring system, the sales price from the distributor to the end-user is monitored, so tax evasion could be reduced."

Tax on consumption

The money collected from tax evaders and other outflows could then be used to assist the poor or to finance infrastructure projects, Najib contended, adding that the rich also pay more under GST or any consumption tax regime, since they tend to spend more.

And as it is a consumption tax, he noted, GST is also a more stable form of government revenue, since the people continue to consume even during a recession.

On the other hand, other forms of taxation are harder to collect, and companies and individuals would dodge taxes if they suffered losses, especially during a recession.

“In summary, Malaysia has lost all its economic advantages, competitiveness, and economic catalysts enabled by GST. The problems and weaknesses of the previous economic structure, such as high corporate taxes, tax evasion, and illicit outflows will return.

“We would also lose our economic capability to withstand a recession or a sharp fall in prices of the commodities we export, without falling into an economic crisis because we no longer have GST to act as a buffer."

Although no longer in a position to stop the government from abolishing GST, Najib said, he still wants the government to know the consequences that the rakyat and the country will face in coming years.

READ MORE

KiniGuide: GST and SST – What’s the difference and why it matters