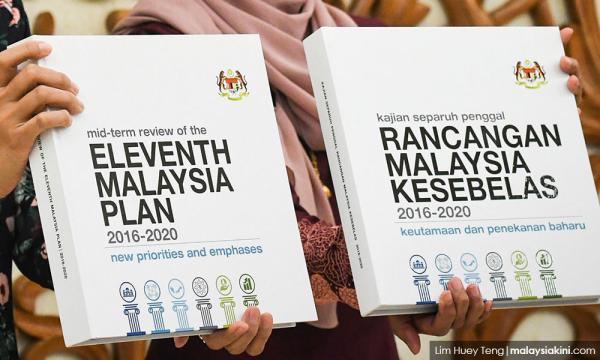

LETTER | The new Pakatan Harapan government must be commended for introducing the Mid-Term Review of the 11th Malaysian Economic Plan (RMK11) with the new goal of ‘sharing prosperity’.

But this prosperity is slowing down - so, how is it going to be shared?

The previous preoccupation with promoting economic growth did indeed neglect income distribution and widening income disparities.

Thus, the rich got relatively wealthier and the poor suffered from this world phenomenon of the widening income gap between the rich and the poor.

We must thus support the Government if they are righting the past wrongs.

Therefore, the growing recognition in our economic planning to more vigorously tackle these unwelcome worsening trends of income inequality, is to be appreciated, respected and promoted more aggressively in the future.

Economic slowdown

How much can be done to share prosperity in reality, when we are slowing down?

Despite these concerns nevertheless, it still remains a worthy goal, which is relatively new in our emphasis, in our traditional overall socio economic planning.

The economy is expected to grow between 4.5 to 5.5 percent in the remaining years of the RMK11 period (2018 -2020).

This is mainly because of the global uncertainties like the world economic cyclical slowdown, Brexit, and now the threats of Trade War between economic giants the US and China.

Our own current estimates of achieving even a 4.5% growth rate can be questioned and remains in doubt.

The mid-term review mentions private consumption growth of 6.8% for 2018-2020, private investment of 6.1% and public investment of only a meagre 0.6% for the same period.

But what if even these low rates are not attained and what if they worsen?

Overcautious mid-term plan, due to debt and deficit?

I would think that the mid-term plan need not have been overcautious in dealing with the RM1 trillion national debt.

After all, the national debt, although very high, is not critical yet. It is still relatively acceptable at about 60-80 percent of the GDP, depending on what definitions we want to use.

In any case, the International Rating Agencies have not sounded the alarm bells and neither have the World Bank and the IMF protested openly.

Thus at this time of global slowdown, should we aggravate the economic decline by drastically reducing the development expenditures by a major slash?

It has been cut by a huge amount of RM40 billion, from an original allocation of RM260 billion for the whole plan period of 2016-2020. Was this really necessary?

Actually, the mid-term plan has been too cautious and its planning could have been unduly affected by the public debt and the budget deficit .

Budget deficit

The budget deficit is now estimated at three percent of the GDP and it is expected to rise from the current estimate of 2.8 percent of the GDP.

Here again, are we being overcautious?

In all reality, there is no legal or fixed obligation to keep the budget deficit rigidly down to a low figure of less than three percent of the GDP. Many countries are doing well with higher deficit ratios.

Of course the major determinants for sound fiscal discipline would be to ensure that the higher development expenditures are used to generate viable income generating projects.

I think we can now assume that there are less leakages and corruption in spending our scarce budget funds.

To its credit, the government is tackling corruption, wastages and leakages much more effectively now.

With so many corruption charges being made at the highest levels, surely we can expect that the fear of being caught for graft has become a severe constraint against committing the crime.

It could be an incentive to be more honest in dealing more professionally with taxes and public funds.

Budget 2019 should not be overcautious

The mid-term plan is only a plan and can be altered and improved as we move along , depending on the global economic developments.

But the 2019 Budget to be presented on November 2 need not be too cautious. It should make amends to the mid-term plan .

Indeed, the Budget could be more counter cyclical and stimulative to achieve higher economic growth and better wealth distribution, as presented and promoted in the mid-term plan.

Proposals to refine the mid-term RMK11 review

Thus for these mid-term plans to be implemented more meaningfully, I would propose the following Budget 2019 measures be adopted.

- Restore some of the major sensitive development expenditure items that have been severely cut. These could include inter alia, low-cost housing, medical and health facilities, education scholarships and training, research and environment protection as well as anti-poverty programmes in both the rural and - especially now- in the new and neglected urban areas.

- Wealth distribution can mainly be attained with higher taxes that can be imposed on the rich. So, what about a wealth tax at reasonable rates, estate duties, property and capital gains as well as sin, carbon and soda taxes?

In conclusion, the mid-term review of RMK11 has to be refined in the Budget 2019.

Unless we are bold and brave and take the necessary Budget measures as above to mildly stimulate the economy; raise wealth taxes and accept that we should not be bound by some rigid economic theories, but be more flexible and pragmatic in our socio economic planning and in formulating Budget 2019; we can only worsen the socio economic challenges now facing us and at least over the next few years.

So let the government strive harder to share wealth, even when the prosperity is slowing down.

The writer is the chairperson of Asli Centre of Public Policy Studies.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.