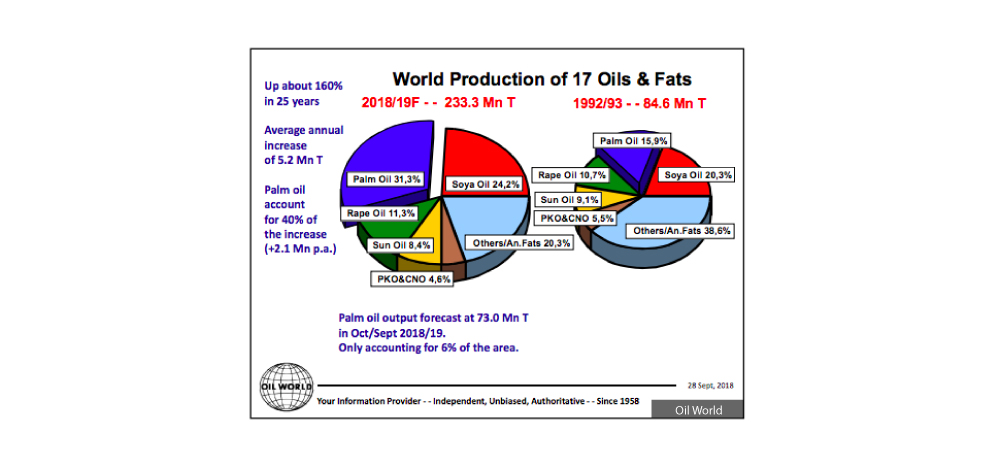

Palm oil, the most widely produced and traded vegetable oil, accounted for 32% out of 230.08 million tonnes of oils and fats produced in 2018 globally. Malaysia, being the second largest producer and exporter behind Indonesia, contributed about 27% or 19.52 million tonnes of this most consumed oil last year.

Top 4 traditional markets

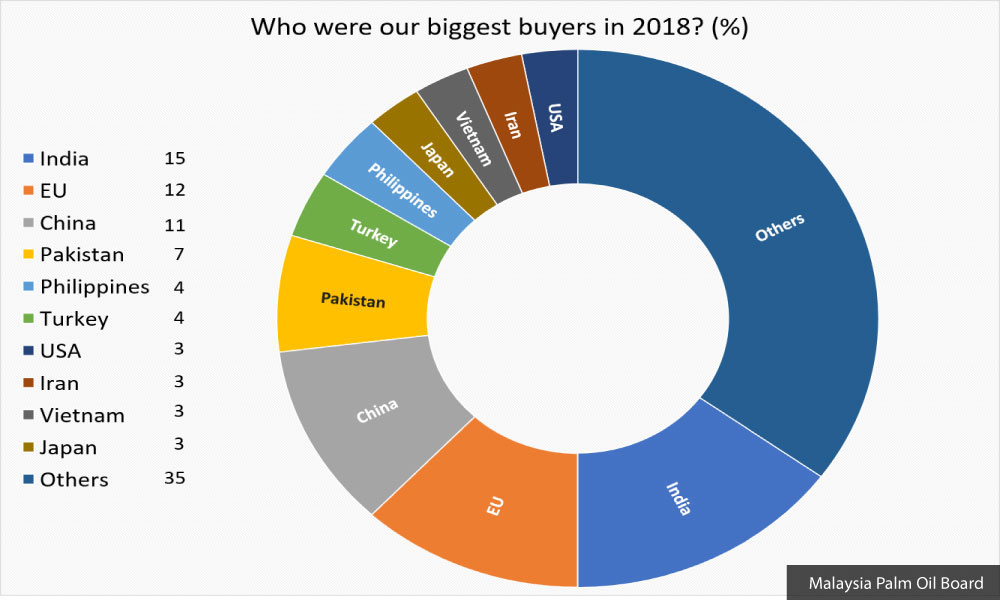

India, the European Union (EU) nations, China and Pakistan were the top four buyers of the Malaysian palm oil in 2018. Apart from the edible oil market, the industry is also exploring other prospective markets such as the surfactant, and margarine and industrial fats markets. The marketability of palm oil is on the rise as the functionality and competitiveness of this crucial commodity make it a sensible choice to support the world’s growing population.

Supporting such views was the chief executive officer of the Malaysian Palm Oil Council (MPOC), Datuk Dr. Kalyana Sundram, who remarked:

“Palm oil is a major global food commodity. More than 75% of the global palm oil production is used for food applications. Independent analyses have repeatedly shown that oils and fats are key ingredients in our food basket. We need oils and fats in our diet. They are the macronutrients that make up the food we eat. There are populations around the world especially those from developing countries that still don’t consume enough oils and fats.”

Supporting growing demand for oils and fats

The prolific research-based industry expert pointed out that as the world population is steadily growing, it is estimated that the oils and fats industry needs to cultivate approximately 200,000 hectares of new agricultural land every year to feed the world.

“Many people have suggested that half of that should come from the oil palm cultivation because of its high productivity,” he emphasized.

Many studies have shown that oil palm tree is the most efficient crop with the highest yield compared to other crops in terms of land use. This simply means oil palm accounts for the smallest percentage (approx. 5.5%) of all the cultivated land for oils and fats, but produces the biggest percentage (approx. 31.3%) of the total global output.

“But there is very limited new agricultural land around the world. There are forecasts that suggest in the next ten to twelve years, demand will outstrip supply in the oils and fats industry,” cautioned Dr. Sundram.

When asked about the market outlook for Malaysian palm oil in the next five years, he was being realistic and optimistic at the same time.

Reinvigorating major markets

“I think consumption in Europe is already optimal with near-zero population growth. So we see Europe as a maintenance market. Not likely to grow much than it already is,” he based his argument on the fact that Europe registered a below 1% population growth rate in the past four years since 2018 and its population is only expected to grow at 0.06% for 2019, according to United Nations’ projection.

The 28-member EU bloc accounted for 12% of our palm oil exports in 2018 while 19 European countries registered negative population growth rates last year, including Bulgaria, Romania, Portugal, Germany, Poland and Russia. The 48-nation continent is expected to see populations decline between 2015 and 2050. Europe is currently home to about 743 million people.

“Ideally, India, China, ASEAN and even Africa look good to be the major markets for Malaysian palm oil, given the fact of their large, growing populations that will naturally come with increasing consumption of oils and fats,” Dr. Sundram singled out the growing potential of these markets, given their sheer total populations of approximately 4,730 million people.

China and India alone make up 18% (approx. 1,420,062,022 people) and 17% (approx. 1,368,737,513 people) of the world population respectively.

In 2018, India was the largest export market for Malaysian palm oil with a 15% intake, followed by EU (12%), China (11%), Pakistan (7%), the Philippines (4%), Turkey (4%), USA (3%), Iran (3%), Vietnam (3%) and Japan (3%), being the top 10 buyers. The other markets, collectively, accounted for the remaining 35% share.

The Malaysian Palm Oil Council (MPOC), together with the Malaysian Palm Oil Board (MPOB), play a key role in promoting and marketing this golden crop, which is presently supporting the livelihoods of 650,000 smallholders in Malaysia.

Exploring new markets

The Malaysian government is enthusiastically eyeing new markets while expanding the existing ones through a series of high-level economic missions led by Primary Industries minister Teresa Kok.

For instance, Malaysia sees Egypt and Morocco as the gateways to Northern Africa, Central Africa and even Europe for more growth potential. Ethiopia, Tunisia, Libya, Benin, Nigeria, Mozambique and South Africa are among the growing markets for Malaysian palm oil.

Saudi Arabia is the other emerging new market to look out for in the Middle East, in addition to the existing strong demand from Turkey.

In Central Asia, countries such as Kazakhstan, Uzbekistan, Kyrgyzstan and Tajikistan have started importing Malaysian palm oil products, according to Kok.

In South Asia, Sri Lanka is another high-potential market to explore while growing the traditional markets of India and Pakistan.

Innovating downstream output

Driven by the advancement of technology and knowledge, more profit growth can be derived from enhancing downstream production with more value-added innovations.

"In this regard, Malaysia looks good to lead the industry through intensive R&D to boost the commercial value of the entire value chain, which will sustainably drive the market growth. Apparently, we cannot be too dependent on the upstream segment simply because the brightest future lies in bringing downstream revenue home to stay ahead of the competition." Dr. Sundram put forward such an important thought.

While we may not have control in market forces like demand and supply of palm oil, prices of competing vegetable oils, weather patterns, export and import policies, the Malaysian palm oil will continue to remain competitive, being a much sought after commodity globally in the foreseeable future.

Surely, Dr. Sundram, will continue to work as hard as can be to safeguard the future of this proven food commodity.