A QUESTION OF BUSINESS | Bank Negara Malaysia’s (BNM) latest quarterly report has an interesting box article beginning on page 26, regarding imbalances in the property market which makes compelling reading.

There’s a lot that the report says about the broad property market, which involves a glut of commercial space itself as well as residential space, but let us focus on residential property for this article.

Already, indications are that the government does not have a proper handle on what the real problem is and instead has put a ban on further approvals for high-end residential property costing over RM1 million per unit.

At this stage that will do nothing to equalise the demand/supply equation because the problem here is basically this, simply put: most of the public cannot afford to buy what is out there. It is a problem of income.

That means the solution in the longer term is to focus on income improvement and reducing income disparity, while in the short term this means nudging the market towards producing more affordable houses and finding the means and mechanism to do that.

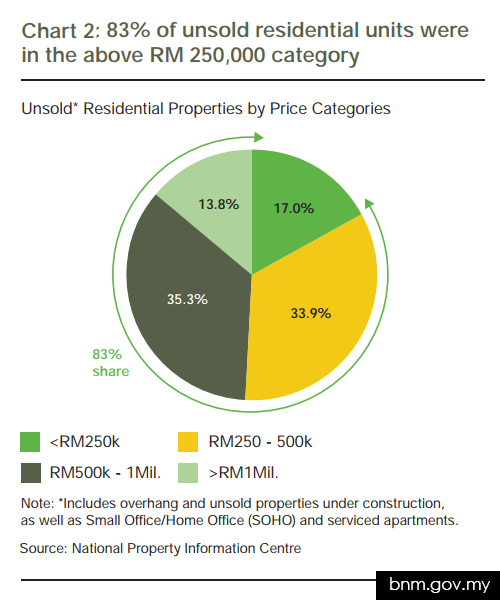

According to the BNM report, supply-demand imbalances in the property market have increased since 2015 with unsold residential properties at a decade-high, the majority of unsold units being in the above RM250,000 price category.

“The large number of unsold properties is due to the mismatch between the prices of new launches and households’ affordability. Over the period 2016 to 1Q 2017, only 21 percent of new launches were for houses priced below RM250,000. This is insufficient to match the income affordability profile of about 35 percent of households in Malaysia,” the report said.

It added that the mismatch was exacerbated by the slower increase in median household incomes, which rose 9.6 percent annually between 2012 to 2016, while median house prices rose 15.6 percent annually over the same period.

“These factors have resulted in median house prices in Malaysia being 5.0 times the annual median household income in 2016, rendering house prices ‘seriously unaffordable’ in Malaysia,” the report said.

While the report emphasises that 83 percent of the unsold units were in the over RM250,000 category, that figure is misleading because it compares one category with the rest. As Chart 2 in the report points out, the least number of unsolds are in the top category of over RM1 million, where it is just 13.8 percent, even less than for under RM250,000, which is 17 percent.

That clearly shows the government move to ban approvals for projects worth over RM1 million is misfounded and will do nothing for the revival of the housing market and reducing imbalances.

The highest unsolds are in the RM500,000-RM1 million category with 35.3 percent, followed by the RM250,000-RM500,000 category with 33.9 percent. So why is that, especially for those units under RM250,000...