The upcoming implementation of the Electronic Invoicing (e-invoicing) in Malaysia and the recent introduction of the MyInvois Sandbox by the Inland Revenue Board (IRB or LHDN) signals the government’s ambition to further enhance our nation’s Digital Economy. This initiative goes beyond simply streamlining the invoicing process and aims to catalyse a comprehensive transformation in how local businesses handle financial transactions.

The MyInvois system is a digital platform tailored to support e-invoicing for businesses in Malaysia. It enables companies to generate, send, and manage invoices electronically, thus ensuring compliance with local tax regulations and enhancing operational efficiency.

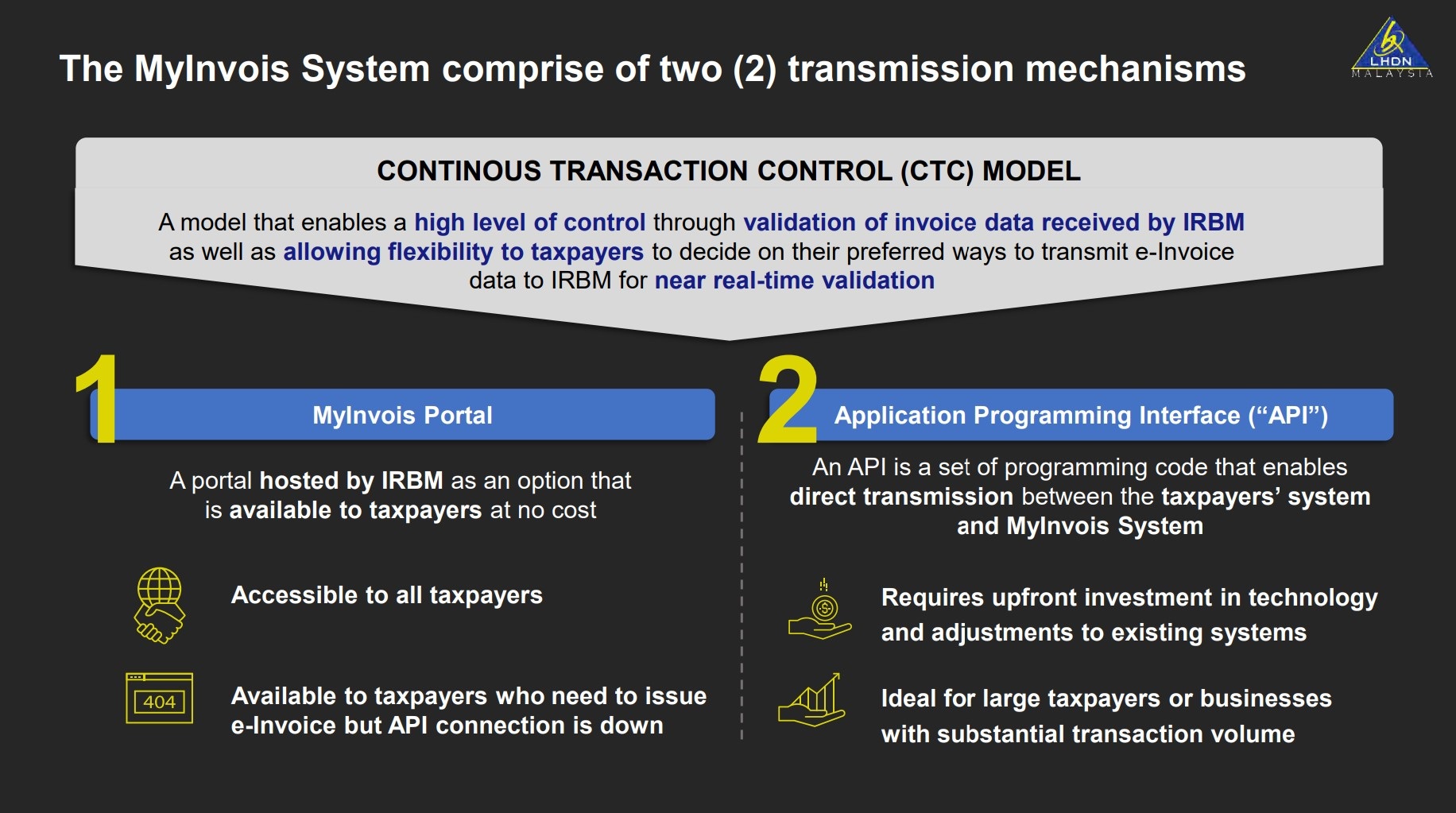

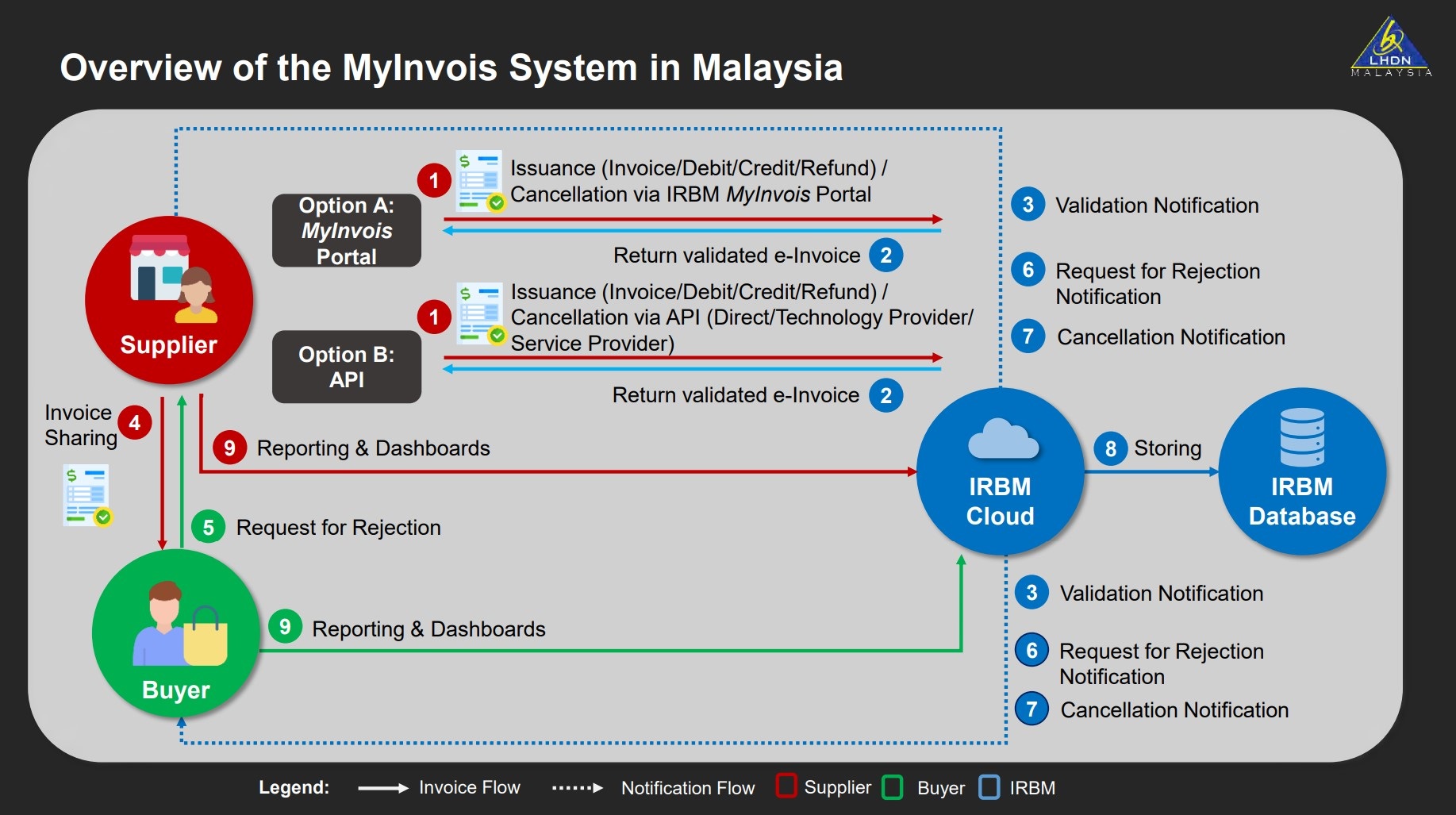

As a central hub, MyInvois comprises two transmission mechanisms:

Through the MyInvois Portal – which essentially is a website that businesses can log in to submit their transactions manually, or

via a secure Application Programming Interface (API), facilitating seamless data exchange and real-time processing.

Accessible from April 10, 2024, for leading companies and from April 22 for other businesses and service providers, the MyInvois Sandbox is a critical tool for testing and integration. This environment allows businesses to align their systems with the MyInvois platform through a robust API.

The government will implement the use of e-Invoice in stages from August 2024 based on the threshold value of business sales revenue. Deputy Finance Minister Lim Hui Ying told the Dewan Rakyat last month that the implementation of e-Invoice serves to also increase the level of tax compliance while benefiting the government, tax administrators and businesses from the aspect of improving business efficiency.

Its implementation will be done in phases, with the first phase starting in August 2024 involving large companies with annual turnover exceeding RM100 million. The second phase will start in January 2025 and involves companies with an annual turnover of RM25 million to RM100 million.

Benefits of e-Invoicing

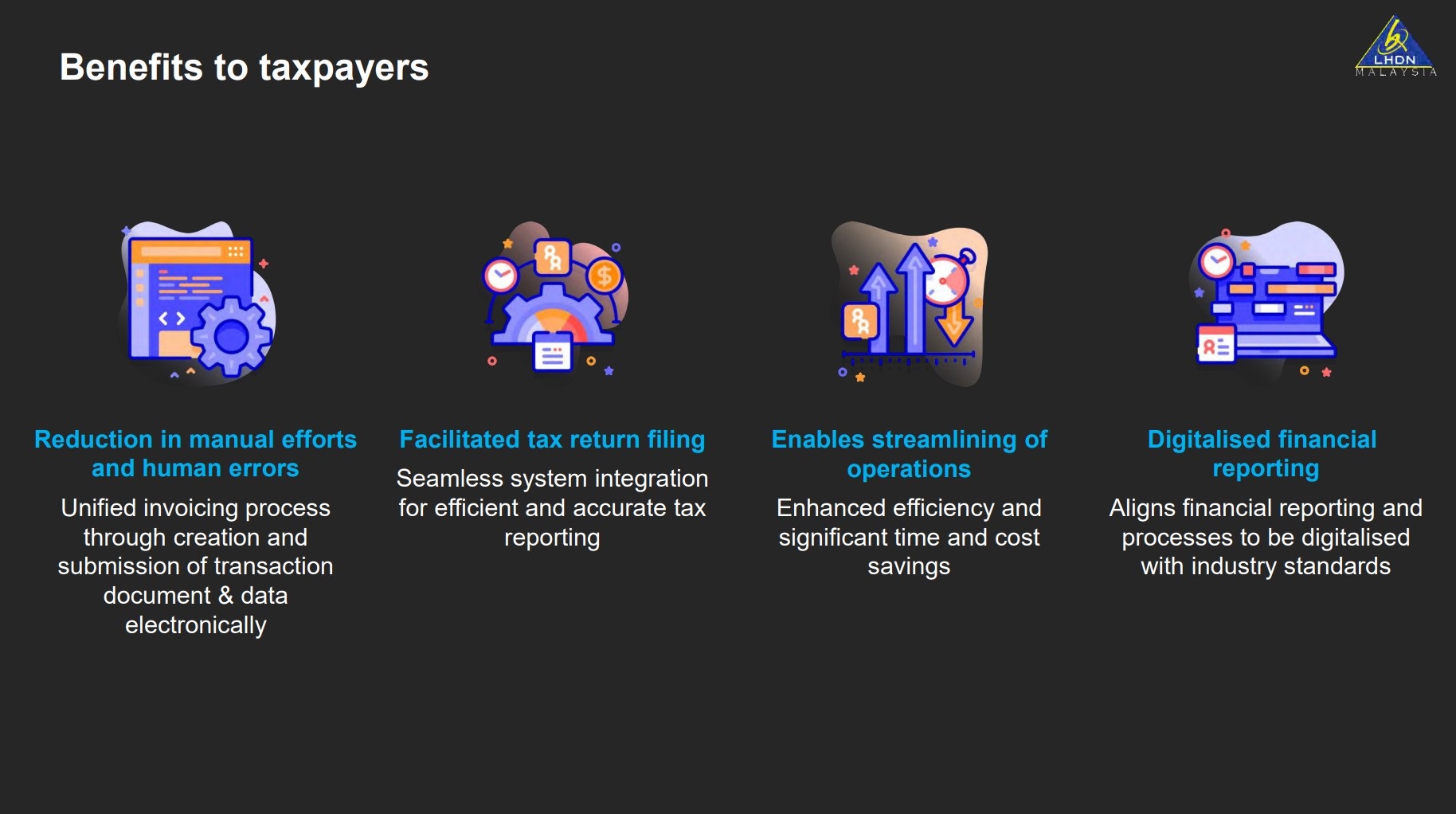

In the context of a swiftly digitalising global economy, the shift towards e-invoicing marks a significant improvement in business efficiency and transparency. It reduces costs, accelerates transactions and minimises errors by automating billing processes, thereby enhancing cash flow. Additionally, e-invoicing reduces the overhead associated with physical paperwork and expedites dispute resolution with clear audit trails.

E-invoicing significantly enhances compliance and transparency, streamlining audits and adherence to financial standards. It promotes environmental sustainability by reducing paper waste and carbon emissions, and enhances security with features that protect against data loss and fraud. These improvements ensure safer financial transactions and help build a more secure business environment.

The unified invoicing process through e-invoicing facilitates the creation and submission of transaction documents and data electronically, minimising manual efforts and human errors. By aligning financial reporting with industry standards, e-invoicing enables businesses to streamline their operations, achieving enhanced efficiency and substantial cost savings.

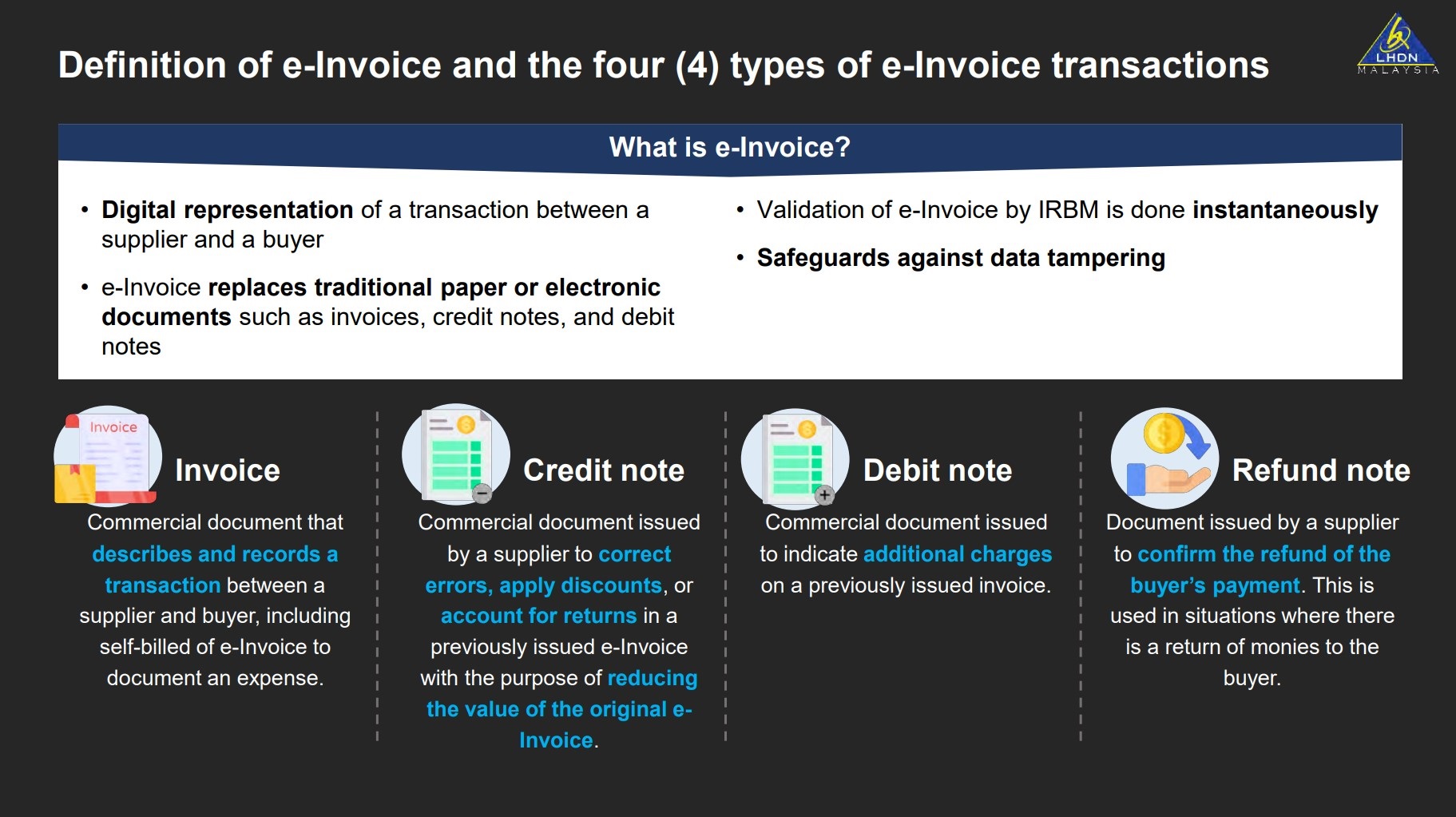

E-invoicing in Malaysia covers all typical types of transactions and applies universally to taxpayers engaged in commercial activities. The e-invoice flow for business-to-government (B2G) transactions is structured similarly to business-to-business (B2B) transactions. For business-to-consumer (B2C) interactions, e-invoices will be issued at the taxpayer’s request. In cases where e-invoices are not required by end consumers for tax purposes, suppliers continue with the current practice of issuing normal receipts or invoices.

As Malaysian businesses embrace the mandatory MyInvois system for electronic invoicing, they face a crucial decision: whether to also integrate via the PEPPOL framework. Understanding the differentiating factors between these two options is essential for making an informed choice that aligns with a company’s specific needs.

Should businesses also adopt PEPPOL?

Meanwhile, there has also been discussions about PEPPOL (Pan-European Public Procurement On-Line), an international framework that facilitates e-procurement and e-invoicing across different systems and borders.

While originally developed in Europe, PEPPOL is gaining traction globally and supports both business-to-business (B2B) and business-to-government (B2G) transactions. This network is particularly suitable for companies that engage in international trade or have to deal with foreign clients and suppliers, as it ensures interoperability across different e-invoicing systems used worldwide.

Therein lies the question: Should businesses be adopting PEPPOL only or PEPPOL + LHDN API approach?

Fact is, MyInvois is set to become a mandatory facet of commercial operation covering the four main document types for e-Invoice transactions: Invoice, Debit Note, Credit Note and Refund Note. Its broad application speaks to the inclusive approach of IRB, ensuring that every commercial transaction benefits from the precision and efficiency of e-invoicing.

Moreover, the inclusive nature of MyInvois means that it encompasses not just business-to-business (B2B) interactions but also extends to business-to-consumer (B2C) transactions. This is particularly crucial for comprehensive tax compliance and facilitates a smoother tax return process for all parties involved.

However, the integration with PEPPOL raises pertinent considerations for businesses with international dealings. While MyInvois is a requisite for compliance within Malaysian borders, PEPPOL offers a gateway for interoperable e-invoicing that also transcends national frontiers, catering exclusively to B2B transactions.

For companies that operate on a global scale, PEPPOL’s network is indispensable. It assures compatibility and streamlines processes across disparate international e-invoicing systems, making it an essential tool for businesses seeking to maintain an edge in the competitive international market.

As a result, for IRB/LHDN e-invoice compliance, businesses that use the LHDN API alone would be sufficient. However, with the addition of PEPPOL, it may be even better for some businesses, especially those which concern B2B type of transactions, to also consider PEPPOL so that they are empowered to share their transaction documents with another business.

Imagine if a certain business need to integrate with ten or twenty or more other businesses, with each of these businesses using different enterprise resource planning (ERP) software and having different documentation formats or structures: With the standardisation of the format based on PEPPOL specifications, every business then would follow the same standard – which would then make it easier for B2B type of transactions to be automated.

Hence, some businesses may choose to implement both the direct LHDN API and PEPPOL frameworks to harness the full spectrum of e-invoicing benefits.

The rationale for this could be multifaceted. For one, a business that operates both locally and internationally would need to ensure seamless integration with domestic requirements via MyInvois while also maintaining the ability to interact with the global market through the PEPPOL network.

Furthermore, adopting both frameworks could provide redundancy and greater flexibility, allowing businesses to pivot between systems as necessary to meet the dynamic demands of their operational environments.

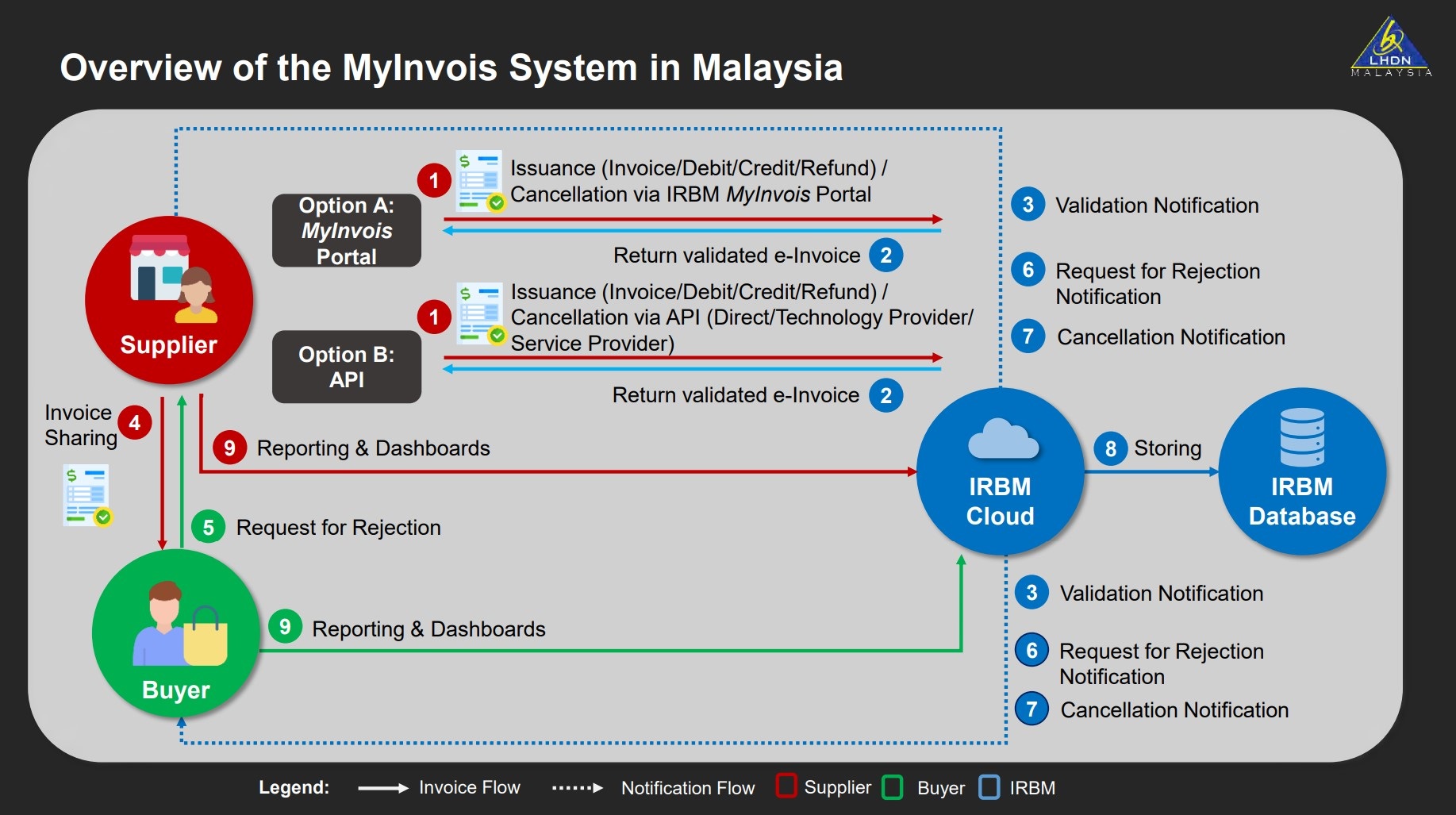

Incorporating elements from the MyInvois system’s API, as depicted in the diagram, we see that the system’s architecture is built to accommodate such a dual-framework approach. At the issuance phase, suppliers have the option to send invoices directly to the IRB or through a chosen technology provider, potentially allowing for simultaneous compliance with local and international standards.

Upon successful validation, the MyInvois system facilitates the return of the approved e-invoice to both the supplier and service provider, ensuring that all parties are synchronised with the verified transaction data.

As the process culminates in invoice sharing, the strategic placement of PEPPOL Access Points alongside Non-PEPPOL Access Points within the service provider’s route showcases a comprehensive system designed to cater to varying business needs. This flexibility is vital for businesses that aim to capitalise on both the domestic advantages provided by direct IRBM interaction and the expansive capabilities offered by PEPPOL’s international framework.

In light of this, businesses must consider their transaction patterns, customer and supplier relationships, and the scope of their market engagement when deciding on the integration of MyInvois, PEPPOL, or both. By aligning their e-invoicing structures with the detailed processes outlined in the MyInvois API framework, businesses can ensure a harmonious balance between adhering to national tax compliance and engaging in global commerce.

In this most ambitious scenario, the dual adoption of LHDN API and PEPPOL equips Malaysian businesses to navigate the intricacies of a digitalised economy effectively.

With the mandatory adoption of MyInvois ensuring compliance and efficiency in B2B and B2C transactions, and the additional implementation of PEPPOL providing international interoperability, Malaysian businesses are poised to thrive in both local and global markets. This forward-thinking approach secures a competitive edge in the digital era, enabling businesses to operate with greater agility, reliability, and strategic advantage in a connected global economy.

At the end of the day, though, the choice between them should be guided by the nature of a business’s operations and its transaction partners. MyInvois, as a requirement for Malaysian businesses, ensures compliance and efficiency in both B2B and B2C transactions locally, while PEPPOL extends this capability across borders, supporting a wider range of business interactions on primarily a B2B basis.

If you’re still confused about e-invoicing, do reach out to us at Wavelet Solutions and we will do our level best to help you navigate through the complexities.

At Wavelet Solutions, we are committed to providing top-tier guidance and support, ensuring that your transition to digital invoicing is as smooth and efficient as possible. Let us help you leverage these technologies to their fullest potential, so you can focus on what you do best — growing your business.

Wavelet can be reached at https://wavelet.net/contact-us/, or via mobile number +6016-299 1588 or email [email protected] .

Note: Wavelet Solutions has been recognised by Amazon Web Services as its ‘Software Partner of the Year for ASEAN 2023’ due to Wavelet’s ability to solve business challenges while simplifying complex digital transformations for a diverse range of clients across Malaysia and the region.

This article was provided by Wavelet Solutions Sdn Bhd.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

Interested in having your press releases, exclusive interviews, or branded content articles on Malaysiakini? For more information, contact [email protected] or [email protected].