The threat is real. Scores of small and medium-sized enterprises (SMEs) have folded due to the outbreak of Covid-19 and the many iterations of the Movement Control Order (MCO) to curb the pandemic. The survival of scores hangs more in the balance.

Since the onset of the Covid-19 pandemic, many businesses have been struggling to stay afloat due to the numerous disruptions. Lockdowns, halt to operations, work-from-home arrangements, reduced manpower capacity, delays in payments – each bringing its own challenges, threatening not just companies’ revenues and earnings; for some, their very survival.

With the global health crisis threatening more disruptions to businesses, having a smooth cash flow is now more important than ever. In fact, a recent survey conducted by the Small & Medium Enterprises Association Malaysia (Samenta) in mid-June 2021 revealed that 30% of SMEs in the country would run out of cash during the full MCO (FMCO). Alas, according to World Bank’s Covid-19 Business Pulse Survey round 2: Impacts of Covid-19 on firms in Malaysia, Malaysian firms have a relatively lower liquidity buffer relative to regional peers, with the median firm only having two months of cash flow available. On average, firms have less than five months of cash flow available.

Smaller businesses generally have smaller cash reserves and this translates to a thinner cushion to fall on when disruptions hit. They also operate on a small margin between inflow and outflow of cash, which means any delay in payments could cause distress to their overall cash flow and liquidity.

Theoretically, businesses can easily plug the cash gap by taking on additional financing but in practice, banks are often less than enthusiastic in providing financing during bleak times. Moreover, banks typically take about 1-3 months to process a loan application, depending on the complexity of the case. During trying periods like this, few can afford the uncertainty and wait.

This is where alternative financing solution providers like CapBay come in. CapBay has helped many small businesses manage the disruptions with its quick and efficient financing.

CapBay, an Securities Commission (SC)-approved home-grown Multi Bank Supply Chain Finance and Peer-to-Peer (P2P) financing platform offers Supply Chain Financing solutions that can help SMEs in every phase of their business to thrive and withstand the impact of the Covid-19 pandemic.

CASE STUDY - CapBay’s financing came to the rescue of a struggling business

Mr Lim owns a company supplying construction materials to government contractors. Being in what is considered a high-risk manufacturing industry, his company has been forced to work at a minimum capacity to comply with the safety regulations set by the government since the start of the first MCO. This slowed down its production, yet he had to continue honouring salary payments, financial commitments and other expenses. The payment terms he offers to his customers also made it difficult to manage his cash flow.

When Mr Lim was looking for a solution to his cash gap, he was introduced to CapBay’s supply chain financing by a friend. Based on the credit scoring on the credit quality of Mr Lim’s customers, i.e. government contractors, CapBay approved his application in less than 72 hours.

Today, despite the numerous iterations of the MCO and lockdowns, Mr Lim can stay on top of his cash flow with CapBay’s financing solution. He has even gathered the confidence to take on new customers without worrying about the cash trapped in the supply chain.

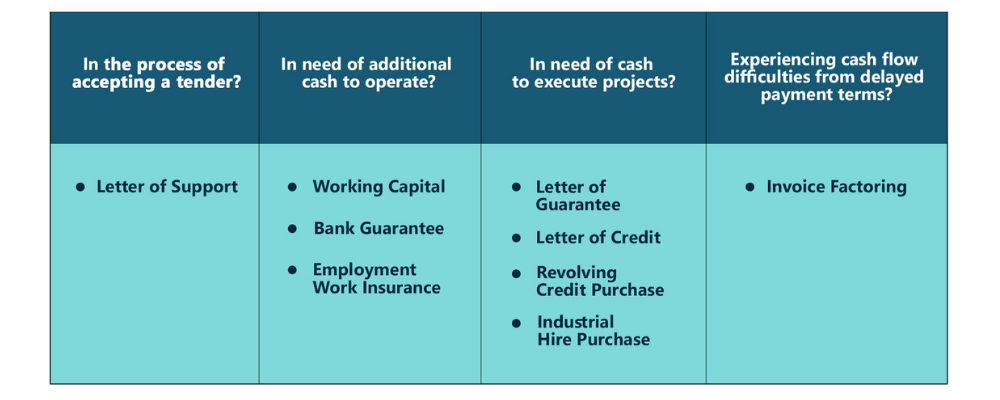

CapBay is able to help SMEs in whichever stage their business is in:

(Read our article on CapBay’s Invoice Financing)

Getting financing should not be an ordeal. To make financing easy, CapBay requires your business to meet only a few simple criteria as follows to apply for its solution:

Has been in operation for at least 1 year

Your business is providing services or goods to other Malaysian businesses on credit terms (B2B)

You’re a Malaysian registered business, with at least 51% local shareholding.

CapBay’s Referral Programme: You can also earn extra cash by participating in CapBay’s Referral Programme. Simply refer an SME and be rewarded with RM300 cash!

Click for more information on CapBay’s smart financing solutions for SMEs.