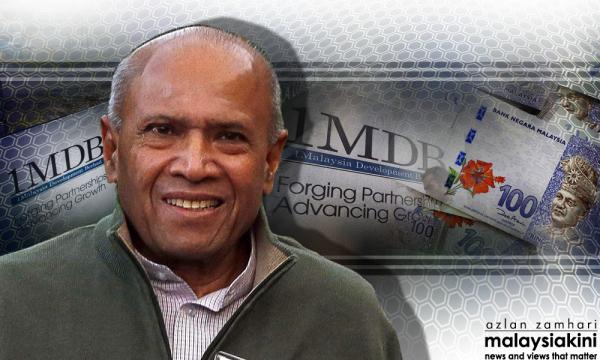

1MDB today announced that it had repaid a RM2 billion loan put together by tycoon T Ananda Krishnan.

Ananda Krishnan had stepped in with the RM2 billion loan last year at the height of 1MDB's financial woes when it was struggling to repay another loan of the same amount to Maybank and RHB Capital.

"1MDB is pleased to announce that it has prepaid, in full and in advance of the repayment date, a RM2 billion facility from Marstan Investments NV.

"This facility was entered into in February 2015 and proceeds were used to repay RM2 billion of debt owing to a syndicate of domestic banks.

"The facility was arranged for 1MDB by Tanjong, as an alternative to a commitment by Tanjong, to invest RM2 billion of equity in 1MDB subsidiary, Powertek Investment Holdings Sdn Bhd," said 1MDB in a statement today.

1MDB said the repayment was a significant for the company's debt reduction exercise.

"This repayment marks another major milestone in the 1MDB rationalisation plan and further reduces 1MDB’s short term debt obligations," it said.

According to The Edge Financial Daily , 1MDB was supposed to repay the loan to local banks on Nov 30, 2014 but failed to do so.

It was given an extension until Dec 31, 2014 and another extension until Jan 30, 2015 when it still could not cough up the money.

It sought a third extension, but was rejected by the local banks, leading to Ananda Krishnan stepping in.

The RM2 billion put together by Ananda Krishnan last year had raised speculation that it was a bailout with demands that the government disclose how the tycoon would benefit.

1MDB later clarified that Ananda Krishnan's Tanjong PLC was obligated to subscribe up to RM2 billion in equity in 1MDB's subsidiary, Powertek Investment Holdings, based on a previous agreement.

1MDB had in 2012 purchased power assets from Ananda Krishnan's Tanjong Energy for RM8.5 billion.

The Malaysian fund said the obligation would be triggered on the "occurrence of certain events" but had declined to reveal the details, citing agreement confidentiality.

Ananda Krishnan chose not to subscribe in the equity and instead arranged a RM2 billion loan for 1MDB.